It seems that Vadim Varshavsky alone had to "take away" for funds on Gazprombank loans for Mechel, and Igor Zyuzin, who once managed one of his assets, was "out of business."

Mechel Group of Companies Igor Zyuzin and its Chelyabinsk Metallurgical Plant (CHMK) entered into an amicable agreement with Gazprombank on debt restructuring of $320 million to this credit institution. We are talking about tranches from 2010.

You can rejoice for Mr. Zyuzin and his company, which a few years ago was called a real "zombie" in the metallurgy market. The incense-breathing structure was able to cope with a significant part of its financial problems, although it was predicted to collapse completely.

However, the question remains - where did the money that Gazprombank eventually tried to recover go? Rumor has it that part of the funds could have been withdrawn through the Zlatoust Metallurgical Plant (ZMZ) of Vadim Varshavsky, now sitting behind bars. In addition, part of the funds could "dissolve" in loans that the ChMK does not know why it provided to other structures of Zyuzin.

The Moscow Post correspondent understood the situation.

Both Gazprombank and Mechel do not hide their satisfaction. According to the agreement, within two years the metallurgical holding must pay 11 billion rubles "on conditions comfortable for both parties," and part of the debt will simply be written off.

They quarreled, shook hands

Meanwhile, Gazprombank did not directly lend to Mechel. It was about three loan tranches under the agreement of the ChMK and foreign banks from 2010. Then GPB through the French BNP Paribas Bank financed CHMK for $219 million. Mechel acted as a guarantor for the loan. But when it came time to pay the bills, the oligarch's structures for some reason did not have money.

According to Zyuzin himself, the money was needed for the construction of rail and rail steel at the ChMK. And in addition to the aforementioned agreement with GPB, the money was taken directly from the aforementioned French bank (in the amount of 102 million euros) and Unicredit bank ($89.2 million).

As for the current situation, Mechel had to pay its debts until 2019. However, against the background of the difficult economic situation in the holding, payments stopped in 2014. After that, the parties came into conflict. Among other things, Mechel tried to bring BNP Paribas to subsidiary liability, but to no avail.

Igor Zyuzin, as always, managed to agree. Photo: https://im.kommersant.ru/Issues.photo/CORP/2015/06/29/KMO_148851_00108_1_t218_140150.jpg

In April 2023, GPB filed a claim for debt collection. Together with interest and penalties, $244 million came out, while the total debt amounted to over $300 million. In the summer, the court satisfied the bank's demands, but Zyuzin's team appealed. As a result, the parties managed to agree.

Vali on Varshavsky

Where the money received on all these loans could go is a good question. According to our information, the situation may be related to business relations between Mechel and the structures of the former State Duma deputy Vadim Varshavsky.

One of the main assets of Vadim Warsaw was the Zlovatoust Metallurgical Plant (ZMZ). In 2021, the businessman was found guilty of especially large-scale fraud and sentenced to seven years in prison. As it was possible to establish, back in 2012, he stole 2.8 billion rubles of credit funds allocated for the development of ZMZ from Petrokommerts Bank. At the same time, Varshavsky's defense tried to prove that he acted only as a guarantor for the loan, which was allegedly carried out only according to documents in order to improve the bank's financial statements.

After transferring 2.8 billion rubles, the money was withdrawn to the account of the Chelyabinsk company Metallurg-Trust, and from there to the accounts of the offshore structure Masterking Trading.

And what about Mechel, ChMZ and Igor Zyuzin? The fact is that back in 2009, just before these events, the Varshavsky ZMZ was transferred to the management of Igor Zyuzin's Mechel. As part of a partnership agreement with ZMZ and the regional authorities, the Chelyabinsk Metallurgical Plant was supposed to supply raw materials to the plant at fixed prices.

Recall that the decision to connect Zyuzin to the rescue of the ZMZ, which was on the verge of collapse, was made after a meeting with Vladimir Putin, who then served as Prime Minister. Zyuzin missed a similar meeting a year earlier due to illness - just then there was a famous episode when Putin promised to call the doctor's metallurgist.

In the case of ZMZ, analysts assumed that Mechel would not directly benefit from the partnership. What are the advantages for Zyuzin then? After all, it is difficult to believe that he just rushed to support Varshavsky. According to insiders, apparently, between the structures of Zyuzin and Varshavsky there was to be a money "exchange" with benefit for both - just with a loan from Petrokommerts. If true, something seems to have gone wrong. Part of the funds on Mechel loans could be withdrawn through ZMZ. And as a result, all the "dogs" were lowered to Varshavsky.

This is just a version. But the partnership between Zyuzin and Varshavsky was not limited to this. Among other things, in 2011, just before the start of the history of Mechel and GPB, Igor Zyuzin invested in the Rostov Electrometallurgical Plant, as well as ZMZ, which was part of the Estara group of Varshavsky.

At the same time, Mechel could therefore be associated with the owners of Estar. The Panamanian offshore Carmenvalley, which owned the Volgograd Small Diameter Pipe Plant (VZTMD, part of Estar), in 2008-2009 owned a stake in CoalMetbank, associated with Mechel. The beneficiary of a number of other offshore companies - owners of Estara companies - was Dmitry Chikishev. His namesake in 2009-2011 headed the legal department of NK Invest, and before and after he worked at Mechel.

It seems that Vadim Varshavsky regretted ten times that he had contacted Igor Zyuzin. Photo: Valeria Melnikova/RIA Novosti

In addition, it is known that during the same period Mechel bought four Varshavsky enterprises at once - DEMZ, the British Invicta plant, the Cognor trader and the Lomprom Rostov salmon picker. Varshavsky himself argued that much more assets were reissued on the Mechel structures.

As the owner of the Volgograd plant "Red October" Dmitry Gerasimenko, who bought the property of ZMZ in 2013, later said, he agreed on a deal with top managers of Mechel, including personally with Zyuzin.

In light of the above, it can be assumed that if Zyuzin participated in frauds, then by that time he could be in this far from the first roles. It is also suggestive of these thoughts that after the transfer of ZMZ and other assets to the management of Mechel structures, Mr. Varshavsky worked from the Zyuzin office, and even received a corporate SIM card.

As a result, as you know, Varshavsky was able to return his assets. And then he argued that it was Zyuzin who was to blame for his troubles. And even if the former State Duma deputy is not a saint, the role of the master of Mechel in this story remains ambiguous - what if Varshavsky acted as a "scapegoat"?

You won't get money from ChMZ

Today these are the affairs of the past days. Let's repeat, Zyuzin was supposed to pay off debts to banks in 2019, but the proceedings continued for the next few years. Already in the twenties, a strange thing began to happen at the Chelyabinsk Metallurgical Plant. In 2021, and before the start of the main court battles with creditors, Mechel withdrew 67 billion rubles from the ChMZ in favor of the parent company. Pravda UrFO wrote about this.

What it was done for is still a mystery. No less interesting is the fact that in 2022 ChMZ signed several loan agreements with another subsidiary of Igor Zyuzin's holding, Mechel-BusinessService. Moreover, only a couple of days were given to fulfill the terms of the contracts of the latter. Today, the losses of Mechel-BusinessService in 2022 exceeded 65 million rubles.

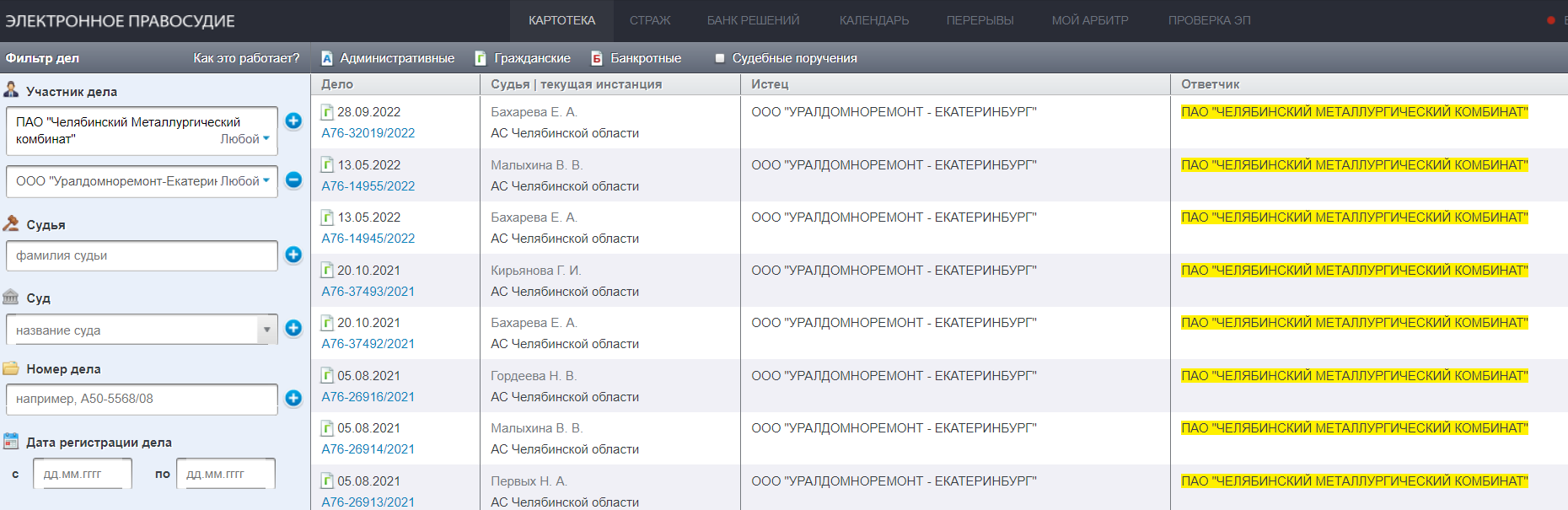

At that time, ChMZ was literally littered with claims from counterparties. About 20 lawsuits were received from Uraldomnoremont-Yekaterinburg alone regarding the payment of repair services for the blast furnaces of the enterprise. At the same time, most of the requirements were limited to several hundred rubles.

Photo: https://kad.arbitr.ru/

Apparently, Mr. Zyuzin is playing some of his own game, the purpose of which may be to dust the eyes of many creditors against the background of the main agreement with the GPB. The head of Gazprom, which owns the bank, Alexei Miller, must understand that Zyuzin's actions can be regarded as opaque and illogical. But illogical in terms of a normally functioning business.

It seems that the happy star finally smiled at Zyuzin, who was still able to bring Mechel out of the threat of complete collapse. Only by what means has this been done, and will the current restructuring really allow the return of budget money (after all, Gazprombank belongs to the state)? So far, this issue has not been finally closed.

.jpg?v1695875598)

.jpg?v1695875598)