The Moscow Post found out how the former banker Vladimir Preis could withdraw the money of the Russian House of Seleng offshore. And if the depositors of the financial pyramid are left with nothing, then Preis is thriving.

New interesting details of the banking activities of the co-owner of the collapsed bank "Monolith" Vladimir Preis have surfaced.

According to The Moscow Post, back in the 90s, through the banks BAM-Credit and Russian House of Seleng, it was Preis who, using offshore companies, could participate in the scheme to illegally deprive depositors of over 70 billion rubles.

Dashing 90s and "native" MMM

Recall that both financial offices began to rapidly collapse against the background of a corporate conflict between the later defendants in criminal cases Pyotr Yanchev and Lev Weinberg. The latter is a friend of Preis from his student years.

BAM-Credit was deprived of its license in 1998 for non-fulfillment of obligations to creditors and depositors. Yanchev's friendly "Russian House of Seleng" "folded" in three years, leaving millions of depositors without investment, who trusted promises to increase their resources. Such companies are commonly called MMM.

Vek journalists describe the connection between the two financial organizations as follows: BAM-Credit was initially positioned as the leader in financing gold mining. But in fact, the main task of the bank was to launder money collected from the population of Russia by the Russian House of Seleng, one of the largest financial pyramids.

Vladimir Preis in this system headed the Moscow branch of BAM-Credit. As the Vek journalists wrote, (later they denied this information, but we cite them as a possible background to the story) just a few weeks before BAM-Credit was declared bankrupt, all the assets of its Moscow branch were transferred to the Preisovsky bank "Monolit."

Now this monetary institution, despite its promising name, is located in the so-called "Book of Memory" of banking assets. The license from Monolith was revoked in 2014 due to its inability to satisfy creditors' claims for monetary obligations.

And his leadership fell under criminal prosecution. Moreover, none of the Preys, as they say, was injured. According to investigators, from 2012 to 2014, the management of Monolit, represented by the ex-board of this credit institution Alexander Danilin and his first deputy Andrei Ikramov, issued unsecured loans in the amount of 6.4 billion rubles to almost a hundred commercial structures.

Foreign "cubes"

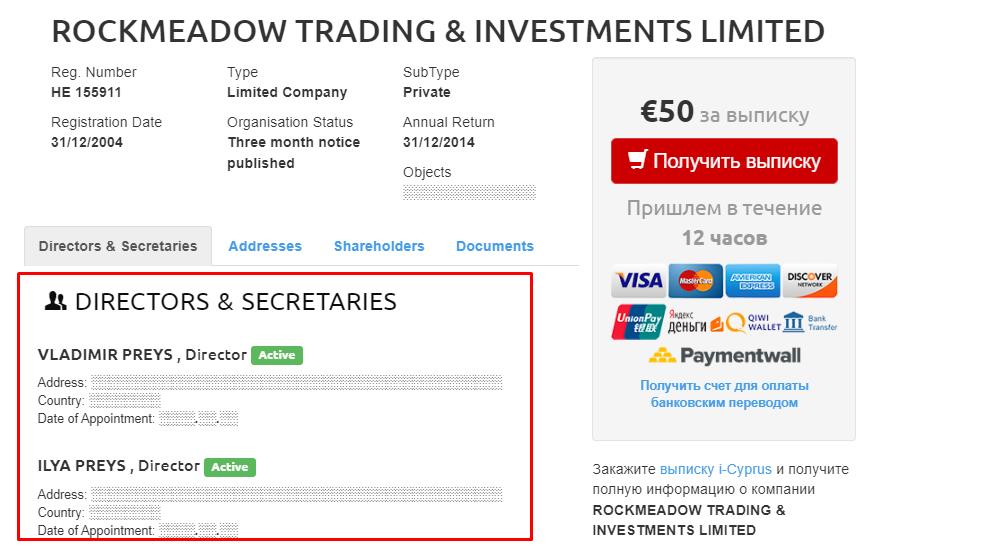

According to the informant The Moscow Post, allegedly to withdraw funds, including used offshore Brownypool Traiding Ltd, in the leadership of which Vladimir Preis and his son Ilya are still listed.

Photo: https://opencorporates.com

The latter, together with another offshore Angara Mining plc, "lit up" in a legal dispute between Gazprom Neftekhim Salavat and PZTSM-Vtormet (Vladimir Preis was the general director), which a few years ago almost privatized the precious metals owned by Gazprom. The fact is that the subsidiary of the gas giant kept these values in the warehouses of PZTSM-Vtormet, and then a bankruptcy and surveillance procedure was introduced against the latter, and Gazprom stopped receiving information about the location of this property.

Angara Mining plc July 14, 2005, closed April 24, 2018. According to Regnum, she controlled Brownypool Traiding Ltd.

Brownypool Traiding with Angara Mining Plc was also related to the ownership of Vasilievsky Mine CJSC (Krasnoyarsk Territory) before their shares were transferred to Gazprombank in 2011 for debts. At the same time, Vasilievsky mine and Angara Mining have become affiliates of Gazprombank since September 14, 2010. Bankrupt, but lost nothing?

According to the informant, the actual co-owners of Angara Mining are Vladimir Yuryevich Preis and his son Ilya Preis (each with a third), Peter Golovinov and Andrei Chuguevsky. To date, only Golovinov has formally retained a share in the company of the listed persons.

Since 2004, Golovinov has been president of the Federal Deposit Commercial Bank, as well as, according to the source, director of the Sigges SA financial group (Geneva), president of the Swiss investment company West-East Finance and managing director of BAM-Credit CB.

In 2015, the FDKB was deprived of its license due to non-compliance with federal laws governing banking activities, as well as Bank of Russia regulations, the value of all capital adequacy ratios below two percent, a decrease in the amount of own funds below the minimum value of the authorized capital established on the date of state registration of a credit institution.

According to the banki.ru, the institution pursued a high-risk credit policy related to the placement of funds in low-quality assets. A proper credit risk assessment revealed a complete loss of the bank's capital. At the same time, the credit institution was involved in conducting dubious transit operations in significant volumes.

A whole chain of murky banking activity looms

Personally, Preis Vladimir Yuryevich was still the president of the Transnational Commercial Bank, which in 2015 also lost its license on the same grounds as the FDKB. In addition, KB "Transnational Bank" was involved in conducting dubious operations of clients to withdraw funds abroad in significant volumes.

In addition to the above offshore companies, the money could settle in ROCKMEADOW TRADING&INVESTMENTS LIMITED, which is also controlled by the Prices.

Photo: https://i-cyprus.com

I would like to add that the former top manager and friend of Preis Lev Weinberg, who was detained back in the 90s, was suspected at that time of "pushing" a closing document on the supply by Solev Management through an employee of the Ginalmazzoloto Institute, where he was the head of the board of directors, precious metals.

It turns out that schemes for illegal manipulation of such assets could be implemented at that time?

According to the authors of the site Moment of Truth, Ilya Preis was allegedly accused of manipulating fictitious bills, but, apparently, the case was quietly covered up.

State millions in the hands of a fraudster?

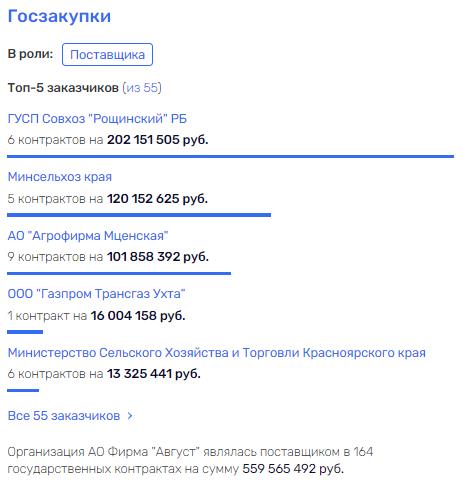

At the moment, a total of 13 companies have been registered for Vladimir Preis in Russia. Three of them are bankrupt, three are liquidated on other grounds, three are no longer functioning. Of the bankrupt, Aslm LLC stands out that in addition to Preis, August Firm JSC belongs. This is a subsidiary of the largest producer of pesticides "August" Alexander Uskov, which receives non-strong government contracts.

Photo: https://www.rusprofile.ru

I wonder how such a structure did not have enough funds for the maintenance of the "daughter"? Or was the money withdrawn from it to offshore companies controlled by Preis?

On Preis senior and junior, Ulug-Hem LLC, which is liquidated, is also registered, which is engaged in the trade in non-ferrous metals. And, although in relation to both founders, according to Rusprofile, there is a mark about the unreliability of the information, we venture to assume that, among other things, metals obtained by not entirely legal methods (as in the story with Weinberg and Ginalmazzoloto) could pass through this office.

According to sources from The Moscow Post, the Preys, who potentially withdrew billions of dollars from Russia, are now abroad, where they are reaping the benefits of their "labor" on their laurels. I would like to ask law enforcement agencies a question - how is this possible?

The Moscow Post asks to consider this article an official appeal to the Prosecutor's Office and the Ministry of Internal Affairs.

.jpg?v1674623922)

.jpg?v1674623922)