Mikhail Fridman and German Gref continue to actively help each other - it is not clear why this is happening using budget funds.

The Russian oligarch Mikhail Fridman, who has settled in London, continues to prepare for the sale of the next Russian asset - the cellular operator VimpelCom (operates under the Beeline brand).

The shares, which are now owned by the Friedman Veon, as part of the withdrawal from Russian assets, are planned to be sold to the top management of the structure itself, although few doubt that Friedman himself will most likely remain the real beneficiary.

Sberbank will help the oligarch with a high degree of probability - read, its head German Gref himself. The fact is that the company has a huge amount of debts - as much as 240 billion rubles, so funds for the redemption of shares will be provided by the state bank on credit. About why Friedman and Gref help each other - in the material of the correspondent of The Moscow Post.

Overlooking Ukraine

The brother-in-law of his brother-in-law sees from afar: this can probably be said about Mikhail Friedman and German Gref. Both are actively engaged in the banking business (Gref is in the rank of a management official), and, according to evil tongues, allegedly long ago they are friends with families.

Today, Mikhail Fridman, who is under a bunch of cross-sanctions, is struggling to be "his" in the West. Many remember his sensational interview, where he wailed that he could not even pay to clean his London mansion. And many believe that after the sale of VimpelCom, it will be Alfa-Bank's turn. And can not "Sberbank" act as a potential buyer?

Moreover, after the start of the SVO to protect Donbass, Alfa-Bank, and Fridman himself, could seriously compromise themselves. In March 2022, the Ukrainian division of Alfa-Bank (Mikhail Fridman is in no hurry to withdraw from Ukrainian assets) announced a program to help the Armed Forces of Ukraine through bonuses and direct transfers. Writes about this "Octagon."

Yes, thereby the Armed Forces of Ukraine, which today cover residential areas of Donetsk with artillery fire.

But leaving Russian assets is not such a simple matter. Gref's help here may be invaluable - who else will help sell a company with debts worth 240 billion rubles?

And after all, Gref helps not only the controversial Friedman. According to the author of a personal blog on the website of the Zavtra newspaper (archival link) Yuri Nersesov, allegedly in the past the head of the state bank was convicted of financing the team of the leader of the Progress Party Alexei Navalny (recognized as a foreign agent, included in the lists of terrorists and extremists in the Russian Federation). The party itself, by the way, was deprived of registration due to a whole shaft of legal violations back in 2015.

And the same author Nersesov calls the other financier of the above comrades on the site "Tomorrow"... two bosom partners - Mikhail Fridman and Peter Aven through the capital of Alfa-Bank. Such is the "coincidence."

Is the son responsible for his father?

It is not possible to confirm this information. But there is definitely something to thank Friedman Gref for. Three years ago, the oligarch rendered the state bank a service - he added his son Oleg Gref to the investment division of Alfa Group, an infamous A1.

The latter is considered by many to be the ideological heir to the Rosbuilding company, which was called almost the alma mater of the domestic leader of unfriendly acquisitions. However, formally, neither Rosbuilding nor the current A1 have anything to do with raiding, but are engaged in work "in the market of special situations."

Namely, they actively participate in corporate conflicts, invest in companies in a difficult financial situation, search for assets and cash... In general, specialists of a wide profile and with colossal opportunities for earning money through a variety of abuses.

For example, not so long ago, The Moscow Post wrote that A1 was trying to sell real estate to Plywood Trade Center (CFT) LLC, which could have been obtained as a result of a possible raider seizure. There will be dozens and hundreds of such stories.

True, the results of Oleg Gref's work in A1 are unknown. Moreover, it is not clear whether it remains in the staff of the structure, and whether it is in Russia at all. After all, he, as if following the example of a possible family friend Mikhail Fridman, after the start of SVO began to sharply withdraw from his Russian companies.

At the end of March, Oleg Gref left the authorized capital of Brain-A.C.-Em, losing his share to Stepan Dmitriev, the son of the ex-head of VEB Vladimir Dmitriev.

But it was even more interesting earlier when Oleg Gref and the Dmitrievs mentioned above worked and were co-owners in Brayne. The company participated in the construction of the fifth section of the Central Ring Road, the money for which was allocated from the National Welfare Fund (NWF). And the fund was filled, including from Sberbank dividends. Which, it turns out, eventually settled in the pockets of Oleg Gref. The cycle of budget money in nature!

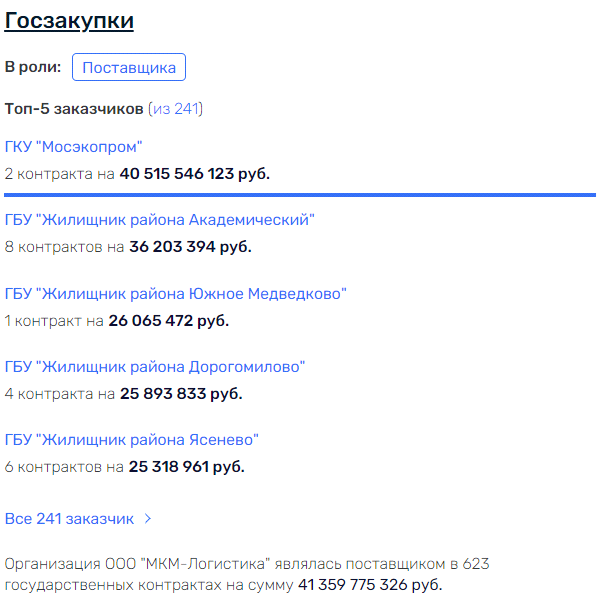

Today, Oleg Gref still remains the owner of four structures, including the common with the Dmitriev family - Pure Logistics LLC, where Gref Jr. has 5%. The company itself is more like a "dummy." But until recently, this LLC owned the waste transportation operator MCM Logistics with government contracts for more than 41 billion rubles.

Photo: Rusprofile.ru

Despite this, since 2019, the company has been incurring losses of tens and hundreds of million rubles annually. Is this the result of the work, including the manager Gref Jr.? And could the influential father of the former beneficiary of the structure not help the firm with obtaining large contracts? While the Prosecutor General's Office is seriously concerned about inflated tariffs for garbage collection in the regions.

However, they say, allegedly without the help of an influential dad, a businessman from Oleg Gref ahovy. In April 2022, he resigned from the founders of the Infrao Project company, which participated in the development of the VIS Group project for the construction of seven polyclinics in Novosibirsk as part of a concession.

Apparently, the designer from Oleg Gref turned out to be ahovy, and the VIS Group of Companies, and the timing of the construction of the clinics themselves, is delayed, which causes serious discontent among the authorities and local residents.

At the same time, the VIS group actively cooperates with Sberbank. The structure managed by German Gref was supposed to finance the construction of a bridge in the Kaliningrad region - then it was about 13 billion rubles. A similar partnership with the VIS Group took place during the construction of a bridge across the Lena in Yakutia. Also, Rostec of Sergei Chemezov appeared in the partners for the construction of these two bridges.

Another major failure of Gref Jr. - the company SLT Aqua, which is engaged in the production of plastic pipes in Togliatti on the territory of the industrial technopark "SIBUR." The business, which is 77.5% owned by Vladislav Mazurk, and 22.5% owned by Oleg Gref, was opened with fanfare.

Allegedly, SLT Aqua planned to supply plastic pipes under the program for the overhaul of apartment buildings. As a result, from 2014 to 2021, the company only twice showed very modest profits, and the owners' shares were pledged to Rossiya Bank.

Apparently, in this case, the Grefs agreed with the Kovalchuk brothers, because such generosity from Sberbank would already look like blatant nepotism and familiarity.

The question "Oleg Gref could have achieved success in business without the help of an influential father" is considered rhetorical by many. Photo: Valery Levitin/RIA Novosti

In any case, the Grefs family business should have enough money and assets. The head of the state bank himself in the past fell into an offshore scandal.

According to Ura.ru, German Gref could be the owner of the Singapore offshore company Angelus Trust, which allegedly follows from the materials of the well-known "Pandora dossier" published by the International Consortium of Investigative Journalists (ICIJ). It argued that an offshore company, as if connected with Gref, could be created to manage family assets for $55 million.

Renouncing the country

Mikhail Fridman probably has his own offshore companies, only funds there should have been frozen due to sanctions. However, he could hide something and go deeper. And he also has his only son, the heir to the entire huge empire of the oligarch - Alexander Ozhelsky.

He, too, found himself under Western and Ukrainian sanctions. And he recently recorded a heartbreaking video in which, in fact, he disowned Russia - he said that he did not support the SVO, left the country after February 24, and did not plan to return at all. RBC wrote about this.

The son of Mikhail Fridman, Alexander Ozhelsky, does not plan to return to Russia. Фото: Alexander Ozhelskiy/YouTube

Does not plan - well, do not. And if he does return, and his dad will no longer have business in our country, then for sure Alexander will be able to get a warm place closer to German Oskarovich. As Oleg Germanovich once sat down in a warm place in Fridman's A1.

.jpg?v1669785357)

.jpg?v1669785357)