In the division of a big fan of various financial and tax schemes, Albert Avdolyan, a new deal with oddities was discovered, from which he smacks of a withdrawal of 75 million rubles.

In the division of PJSC YATEK, within the framework of the so-called internal lending of related persons, a large amount went to Armenia, which never returned. And then, back in January 2024, YATEK issued a loan of 300 million rubles to its unprofitable "daughter."

The UtroNews correspondent understood strange transactions in the YATEK division.

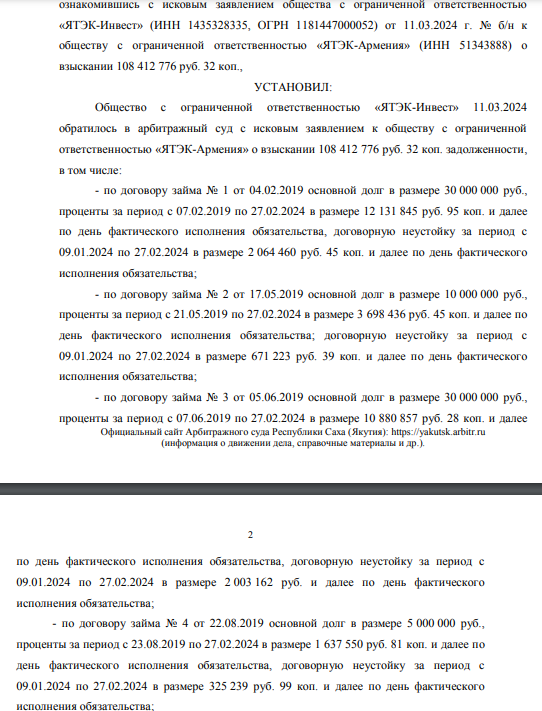

On May 20, the arbitration of Yakutia plans to begin consideration of the claim of YATEK-Invest LLC against YATEK-Armenia LLC. The case is about the return of debt under four loan agreements signed in 2019. The principal amount of the debt is 75 million rubles, and the total amount of claims, including interest, is 108 million rubles. In this story, it is interesting that both companies are the same YATEK division, the beneficiary of which today is the oligarch Albert Avdolyan.

Photo: kad.arbitr.ru

Avdolyan had previously appeared in the story of the withdrawal of 100 million rubles to a bank in Latvia under the guise of certain loans and their return, as well as in the tax scheme, according to which investing his firms was covered by a loan from an affiliated offshore company. The latter was done to save on taxes, but it was the tax authorities who caught the participants in the scheme almost by the hand. In light of this, such domestic lending, in our opinion, smacks more of another schematic, and a lawsuit is some kind of attempt to give legality to transactions. After all, in which case you can shrug your shoulders and say that they tried to return the money, and then write it off as a hopeless debt.

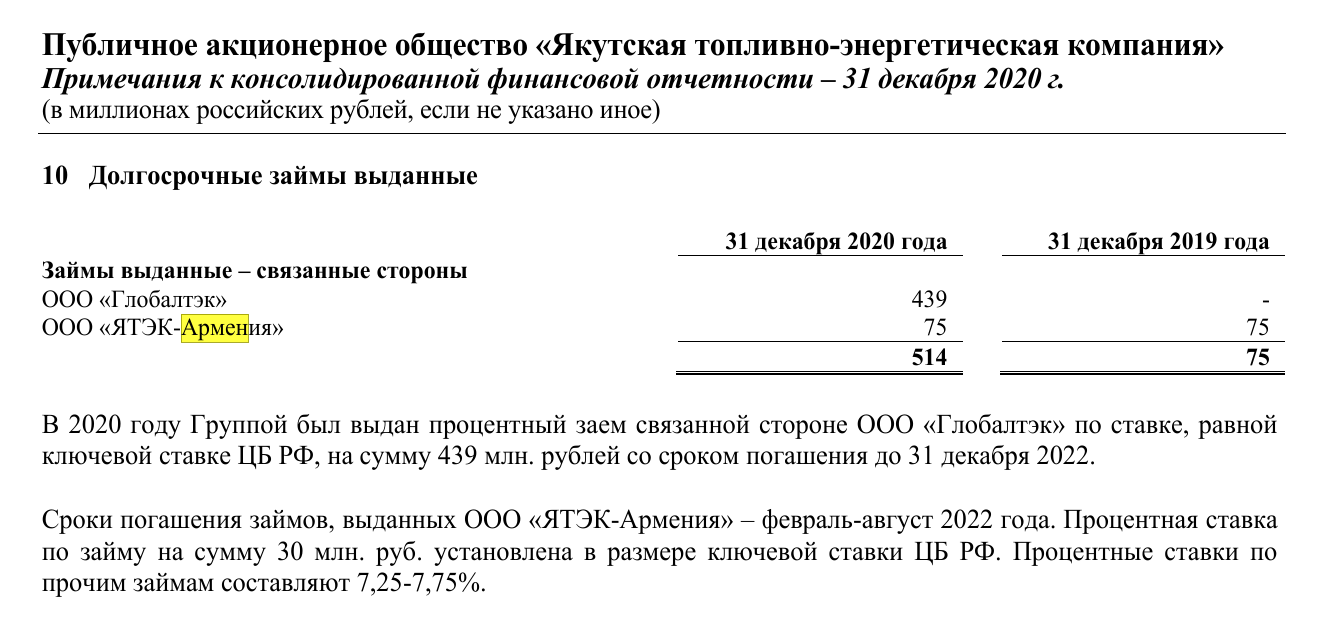

The fact that YATEK-Armenia LLC, created a year before the issuance of loans to it, is directly related to the YATEK division, is also confirmed by the financial statements for 2020. From it, by the way, it follows that the loan was issued at a ridiculous interest rate - at the level of the key rate of the Central Bank of the Russian Federation or slightly higher (but far from market rates). That is, the goal was not to gain at all.

Moreover, the debt matured in February-August 2022, that is, a couple of years ago, and the claim for recovery was filed only in 2024. This, you know, leads to certain thoughts. As well as the fact that the first loan was issued to the company a couple of months after its creation. At the same time, the Armenian legal entity YATEC does not appear in any investment projects, and in terms of its main activity, it is completely engaged in the transfer of its own or leased real estate for rent and other operations.

Photo: bo.nalog.ru

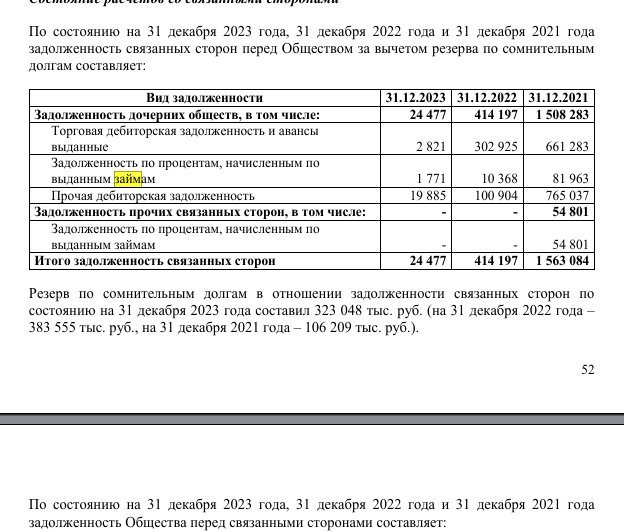

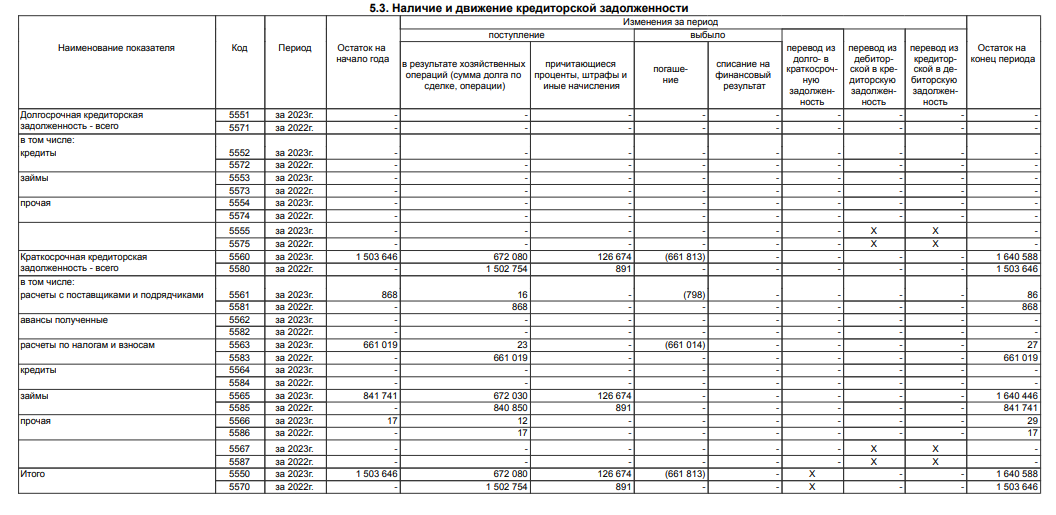

If we look at the YATEC reporting for 2023, we will see the following there: a provision for doubtful debts in relation to the debt of related parties under

as of December 31, 2023 amounted to 323 million rubles. Probably, it also includes the debt of a legal entity from Armenia.

Photo: bo.nalog.ru

According to information from open sources, such a scheme allows you to reduce the tax, since deductions to the reserve are attributed to non-operating expenses and are taken into account when calculating income tax.

And, if the dubious debt lies in the right pocket of one "coat," then there are no losses in fact, only tax savings.

The claim in this case is also quite understandable. The fact is that all expenses that reduce the tax base must be economically justified, confirmed by documents and obtained in the course of profit-making activities. Although in place of the tax, in this case we would have wondered how economically justified those loans were.

On the one hand, Avdolyan received YATEK from the Summa group of Ziyavudin Magomedov only in the fall of 2019, that is, before the conclusion of dubious transactions with a legal entity in Armenia, and on the other hand, the question arises why claims for debt repayment were filed only two years after the expiration of the payment period. In this case, only an increase in debt comes to mind for the subsequent further reduction of the tax base.

It is not superfluous to recall that at the time when the transactions were concluded, the bankruptcy case was being considered at YATEK (then still controlled by Magomedov, who was later convicted of embezzlement). Moreover, in January 2019, the court even introduced a monitoring procedure. That is, the transactions themselves could be terminated for a long time, as concluded in violation of the law.

By the way, in 2020, YATEK also tried to recover 179 million rubles from another of its "subsidiary legal entities" - Mezhozernoye LLC. It was also about loan agreements, but they were concluded during the period when the division was controlled by Magomedov. But the plaintiff himself, who already controlled Avdolyan, did not appear in court and on this basis the case was dismissed.

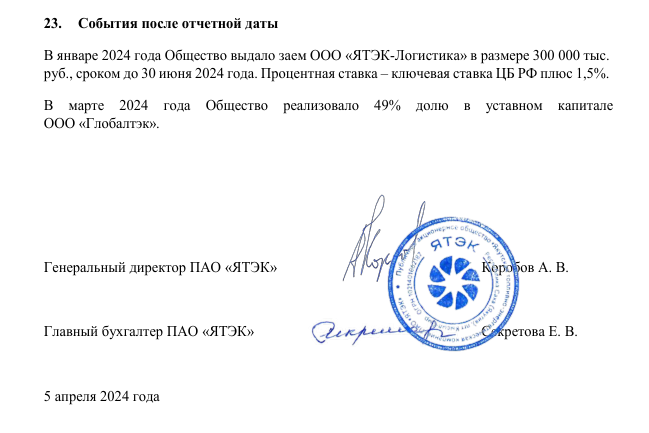

Another interesting fact that hints at the fact that under Avdolyan the story of internal muddy lending continued: in January 2024, YATEK issued a loan to YATEK-Logistics LLC in the amount of 300 million rubles for a period until June 30, 2024. The interest rate is the key rate of the Central Bank of the Russian Federation plus 1.5%.

But here's the bad luck: the borrower for 2023 received 20 million rubles of net loss and zero revenue and PJSC could not know this, since this company is also its 100% subsidiary. Will you later have to "write off" these 300 million and look for bins?

Photo: rusprofile.ru

Photo: rusprofile.ru

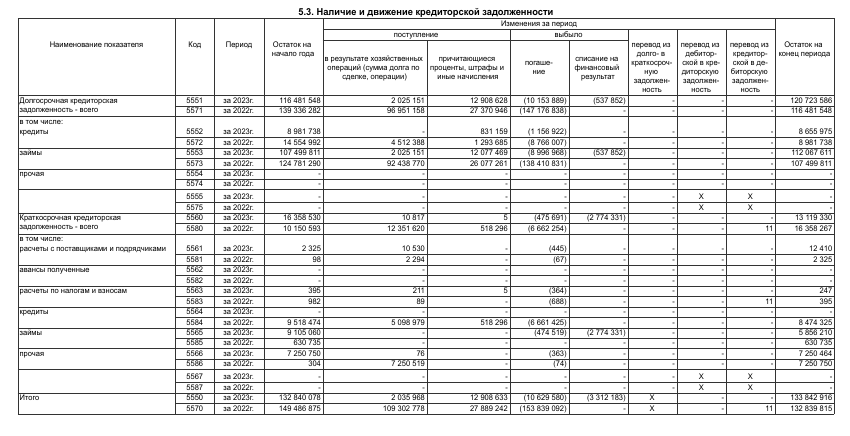

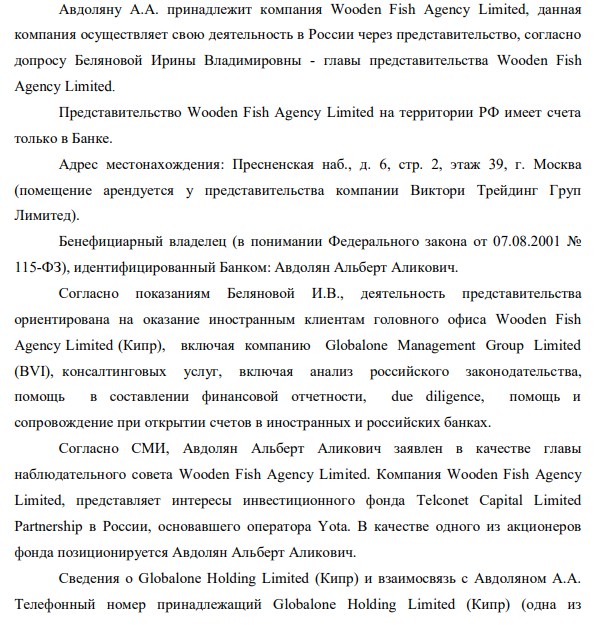

Recall that among the major shareholders of YATEK there are A-Property LLC and A-TEK LLC. At the end of 2023, A-Property LLC showed a loss of 15 billion rubles, and A-TEK - by 20 billion rubles. At the same time, at the end of 2023, the balance of some loans taken amounted to 1.64 billion rubles, and at A-Property the total amount of loans and borrowings exceeded 133 billion rubles. Creditors did not disclose. At the same time, the same YATEK for 2023 showed a net profit of 1.4 billion rubles. A strange picture comes out: shareholders are unprofitable and indebted, the asset does not bring them proper profit to cover debts. Did it smell like controlled bankruptcy plans from somewhere? Moreover, today there is already a claim for the recovery of 189 million rubles that has not been fully considered.

Photo: bo.nalog.ru

Photo: bo.nalog.ru

Offshore pods

But, when offshore companies suddenly appear in history, the "debts" within the division begin to play with new colors.

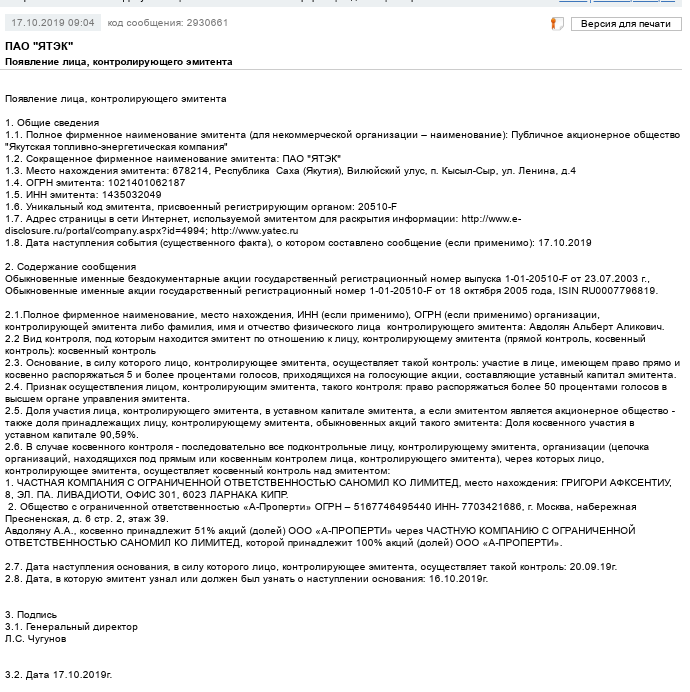

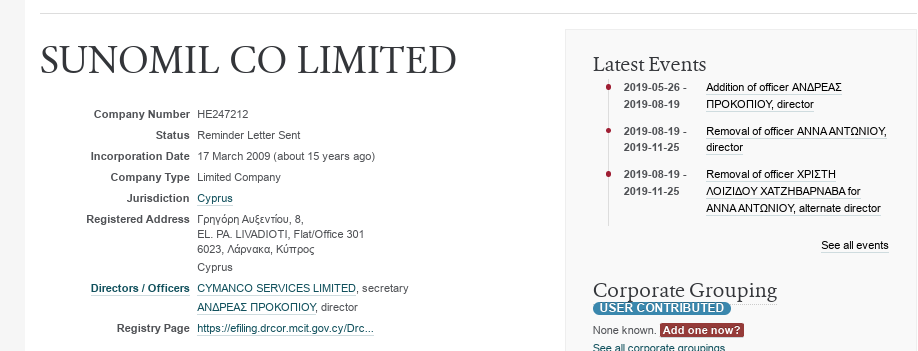

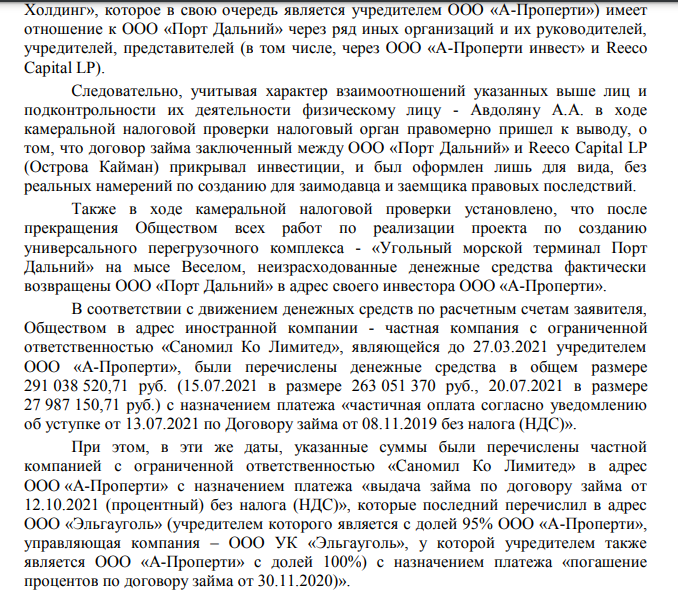

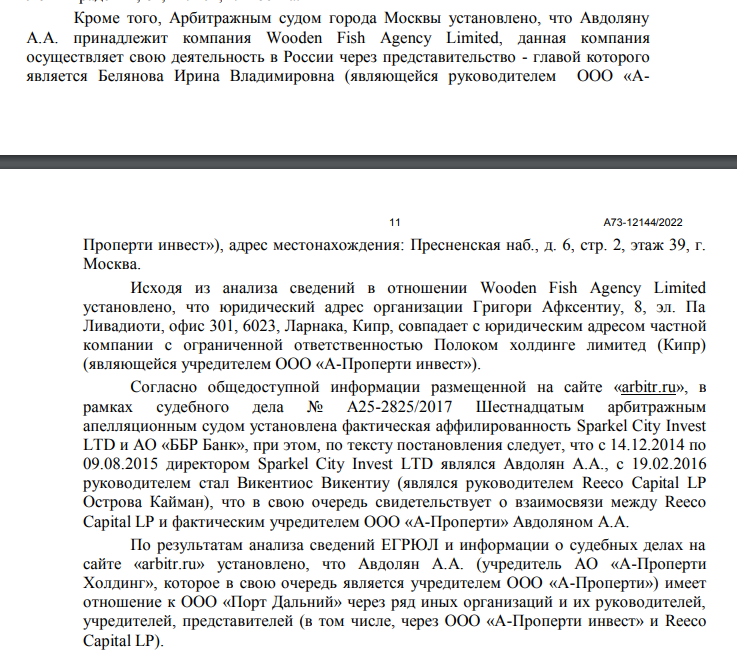

In the chain of ownership of the above firms, AP Holding JSC was also noted, as well as an offshore company, which until May 2021 owned A-Property LLC - the Cypriot Sanomil Co Limited. This offshore, which was connected with Avdolyan and through which he controlled YATEK back in 2019, is now quite operational.

Photo: e-disclosure.ru

Photo: opencorporates.com/

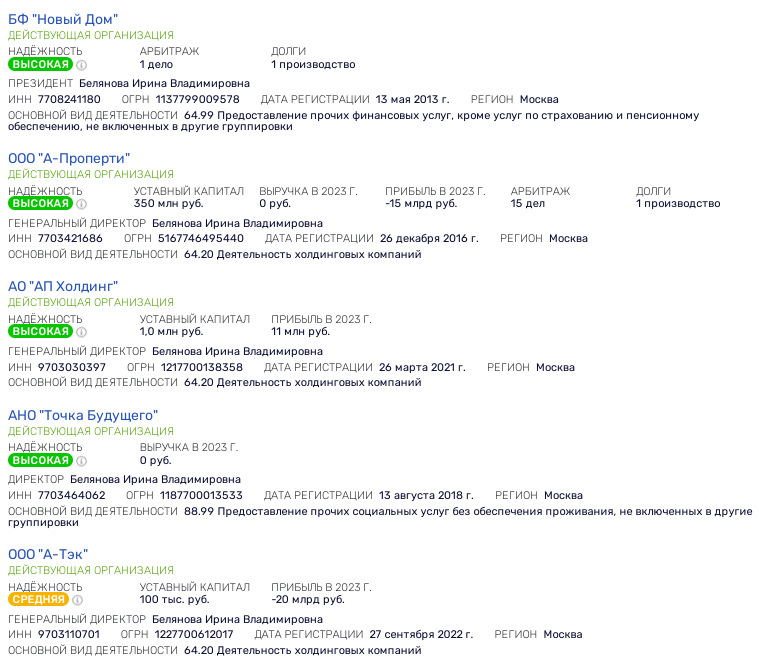

Moreover, the same Cypriot company appeared in the story of dubious lending to Port Dalniy LLC, which took place through a loan of $20 million issued offshore from Cayman Reeco Capital LP.

The Federal Tax Service considered that the scheme covered direct investments of A-Property LLC in the fixed capital of Port Dalniy LLC. SUNOMIL CO LIMITED participated in the transit of the balance of debt, passing 291 million rubles through its accounts.

Photo: https://kad.arbitr.ru

At the same time, the director of Reeco Capital LP was Cypriot Vikentios Vikentiu, who also appeared as a director of Sparkel City Invest LTD, replacing Avdolyan. And Sparkel appeared in the high-profile bankruptcy case of the MRSEN energy holding. The collapse of the latter was preceded by a criminal case, the defendant of which was a relative of Avdolyan - the shareholder of MRSEN Eldar Osmanov. UtroNews spoke in detail about the role of Avdolyan in this story in the past.

Let's return to the shareholders of YATEK.

All three Avdolyan firms that inherited in YATEK - A-Property LLC, A-TEK LLC and AP Holding JSC - are headed by the same person - Irina Belyanova, who was previously noted in a number of offshore stories. So, for example, she appeared as the head of the branch of Wooden Fish Agency Limited, which belongs to Avdolyan and quite successfully continues its activities in Cyprus. Wooden in Cyprus is registered with other offshore companies - Polok Holdings Limited, which was the founder of A-Property Invest LLC.

Photo: rusprofile.ru

Photo: https://kad.arbitr.ru

Belyanova and Wooden also appeared in the story of the withdrawal of 100 million rubles to the Latvian bank JSC Citadele Banka, where Dmitry Gordovich's BBR Bank was involved. The Moscow Post spoke about this in detail.

Photo: https://kad.arbitr.ru

Belyanova is also the head of the New House Foundation, created by Avdolyan. The fund's board of trustees is headed by a longtime acquaintance of the oligarch, the head of the Rostec state corporation, Sergei Chemezov.

Photo: noviy-dom.org

Most likely, the whole secret of Avdolyan's unsinkability, despite the offshore tax schemes, is just in the strong shoulder of a federal official. It was not for nothing that the whole path of the formation of Avdolyan's business Rostec went hand in hand with him, and Rodion Treasure, a native of the state corporation, still appears as a co-owner of the oligarch's division.

.jpg?v1713501451)

.jpg?v1713501451)